Cash is king?

Here is a scenario familiar to many entrepreneurs – the sales are booming and the business is growing rapidly, but suddenly, when asked for payment by a creditor, you realise that you simply don’t have any cash. What has gone wrong?

Here is a scenario familiar to many entrepreneurs – the sales are booming and the business is growing rapidly, but suddenly, when asked for payment by a creditor, you realise that you simply don’t have any cash. What has gone wrong?

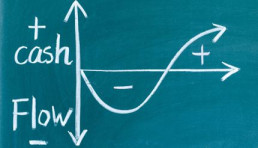

This is the result of a cash flow gap, one of the most common problems that a business can face. In order to solve it, you must first understand why they occur, and what you can do when you find yourself in one. Here is everything you need to know about cash flow gaps and their solutions.

What is a cash flow gap?

Cash flow gaps occur when your cash inflows and outflows don’t line up – for example, you purchase stock and immediately pay your supplier, but it takes several days for you to sell it to a customer. During those few days you have no money back from your purchase, and this period is the gap in your cash flow. They can be caused by a variety of reasons, such as late payments from clients or changes in the market.

Normally these cash flow gaps are easily managed by simply having enough money set aside in preparation. However, if your capital is tied up due to business expansion, then cash flow gaps can quickly become problematic if they coincide with payment deadlines. In extreme cases, cash flow gaps can even cause an otherwise profitable business to go bankrupt.

How to fix a cash flow gap

Short-term solutions

There are a few short-term solutions which can help a cash flow gap; they include but not limited to: selling your account receivables to factoring companies for cash, borrowing additional cash or using an overdraft, delaying payments to your suppliers, incentivising quicker payment from your customers, and temporarily reducing the salaries of your staff.

There are a few short-term solutions which can help a cash flow gap; they include but not limited to: selling your account receivables to factoring companies for cash, borrowing additional cash or using an overdraft, delaying payments to your suppliers, incentivising quicker payment from your customers, and temporarily reducing the salaries of your staff.

Invoice factoring, meaning a business owner sells its invoices to a financial company (a factor) at a discount for immediate cash, is a common way to improve the business’s cash flow. How it works is simple – you sell the invoices to a factor and receive a percentage (usually up to 80%) of the value of the invoices instantly. When the invoices are due, the factor will contact the customers for full payment and upon receiving it, the factor will pay you the remaining balance after deducting factoring service and administration fees. In this process, your customers are made aware of the factoring arrangement.

Invoice discounting is similar to invoice factoring, but during the process of invoice discounting, your customers are not aware of the involvement of the factor, allowing you to sell the invoices and maintain a good relationship with your customers.

Long-term solutions

Long-term strategies to combat cash flow gaps include but not limited to: renting out or liquidating company assets, purchasing only quick-moving stock, limiting stock, and using a cash flow forecast to avoid overtrading.

Having extra stock is often one of the reasons why businesses are strapped for cash. To properly manage your inventory, look very closely at your order history to identify quick-moving stock and pick out periods in which you can keep minimal inventory on hand while waiting for your next order.

Creating an honest cash flow forecast and using it to track your progress can also help tremendously. Keep a look-out for seemingly unrelated events that will have an impact on your business. For example, during a prolonged hot summer, residents across London tend to stay home as opposed to going out. If you’re relying on customers to walk into your shop and the warm weather is likely to affect your business, then make a plan in your forecast and adjust it accordingly. Other events that may also have an impact on your cash flow include currency exchange rates, bank charges and government policy.

Contact Berley for assistance

Cash really is king, as without this fluid capital your business is at risk. If you would like to understand more about cash, cash flow and cash flow gaps, then speak to one of our small business accountants in London today.

For years, we have helped many small businesses across London to strengthen their cash flow management and mitigate the risks associated with cash flow gaps, and we can help you too. To find out more about us and our audit and accountancy services, call us on 020 7636 9094 or get in touch using our Online Form.

If you found this article interesting, take a look at:

- Business hacks: simple ideas to turn your business fortunes around

- Firefighting: what to do when things go wrong

Eight tactics for scaling your recruitment agency

With almost 40,000 recruitment agencies registered in the UK, the recruitment industry is booming like never before. This intense growth rate has created fierce competition, which means now is a good time for recruitment agencies to focus on growth strategies, improve their business operations, and take advantage of any help available for strengthening their market positions.

If growing your business your recruitment agency is your priority, here are eight ways you can increase your recruitment agency’s profits:

1. Recruit on a global scale

It’s an increasingly small world nowadays, and as a result, it’s a good idea to think outside the box and recruit globally. Look at where the talent is and don’t be afraid to go far afield to pursue it. Understand the legal regulations, cultural practices and visa processes associating with hiring talents from abroad, because if you can position yourself as the expert in hiring international talents, you’ll have definite appeal to your clients.

2. Expand into emerging industries

Recruitment agencies tend to specialise in certain sectors, but after a while, this can exhaust your opportunities for growth. Branch out into new sectors and explore what is profitable. The benefit of working in emerging industries is that the competition is still scarce, so if you act fast enough you can build a reputation for yourself before other market players join in.

3. Embrace technology

In a crowded and competitive market, using the right tech can provide the edge you need to stand out. Knowing what the trends are and learning how to exploit them will allow you to respond efficiently to constant technological advancements, which more often than not determines whether entrepreneurs rise or fall.

4. Automate your paperwork

Cloud accounting is becoming increasingly important, especially with Making Tax Digital just around the corner, so now is the time to streamline your processes and do away with the paper trail. For example, a cloud accounting program such as Xero is great for business owners who don’t have strong accounting knowledge. At Berley, we have Xero-certified advisors who can help you to get the most of the accounting software.

5. Create efficiency in process and testing

Time is money. If you’re a recruiter who has to screen big piles of resumes, planning out procedures with each process having a checklist will help. Consider investing in assessment testing as well, which includes hard-skill tests, cognitive ability tests, personality tests, among others, as they help you to better profile a candidate.

6. Invest in your database

Your database is the heart of your agency. If you’re still using a dated database that is not user-friendly, consider upgrading to HR software with a host of capabilities like sourcing and applicant tracking, job dashboard and job analytics.

7. Get social

As you might have expected, Generation Z and Millennials tend to search for jobs using social media and on their mobile device, but most traditional companies don’t consider advertising on social media. As a recruitment agency, you can bridge that gap by having a strong social recruiting strategy.

8. Outsource what you can

Let’s be honest; you started a recruitment agency because you were good at recruiting, not because you were a talented web designer or a gifted accountant. Focus your time and efforts on what you’re good at, and when it comes to specialist tasks like accounting and tax returns, contact specialist recruitment accountants at Berley.

Specialist accountants for recruitment agencies

To be a successful recruitment agency, you need to have a solid growth plan but remain flexible enough to adapt to the changing world. At Berley, our team of chartered accountants and business growth specialists can help you with business strategies with the aim to improve your marketing competitiveness and new revenue opportunities.

Get in touch today on 020 7636 9094 to find out more about how our team can help you.

If you found this article useful, take a look at:

Protecting your latest tech creation

The tech industry in London has never been bigger. Valued at over £180 billion at the end of 2017, the industry is expanding 2.6 times faster than the rest of the UK economy, and it’s generating record numbers of new start-ups. In this rapidly growing market, new technology is immensely valuable.

The tech industry in London has never been bigger. Valued at over £180 billion at the end of 2017, the industry is expanding 2.6 times faster than the rest of the UK economy, and it’s generating record numbers of new start-ups. In this rapidly growing market, new technology is immensely valuable.

As a tech company, your aim is to generate revenue and profits from your latest tech creation, so it’s crucial that you guard your intellectual property. This is an extremely complex area of law, but as specialist tech start-up accountants we’ll help to guide you through it in coordination with legal professionals.

Understanding intellectual property

The first thing you should know is that you cannot protect an idea. You may protect the implementation of an idea and any work that you have done to realise it, but you cannot legally prevent others from using the idea itself. However, you can still protect your work if you understand what intellectual property is.

In simple terms, intellectual property is something unique that you have physically created. For example, an idea for a book doesn’t count as intellectual property, but any words you have written do.

As a tech startup, your intellectual property is likely to be the technology you are utilising and the way you are using it. Unlike an idea, intellectual property can be legally protected in a few different ways.

Different methods of protecting your tech creation

Depending on what you have created, you may need different types of protection. Some are automatically applied, such as copyright and design right, but others are not. The ones you will need to apply for manually are:

- Trademarks

Trademarks cover the advertising and ways you make people recognise your product. In most cases, they protect product names and logos, but they can also stray into other areas such as jingles or catchphrases. You should allow up to four months to apply for one and ensure you know which class (or category) to apply for. Applications in paper form cost £200 for a single class plus £50 for each additional class. Standard online applications cost £170 plus £50 for each additional class.

- Registered designs

Registered designs protect the appearance or design of your product, including shape, packaging, pattern, colour and decoration. You should allow up to one month to register your design.

- Patents

Patents cover the actual inventions and products themselves, often defined as a combination of form and purpose. There are eight stages in applying for a patent through the Intellectual Property Office (IPO), and a fee is required for some of the stages in the application process. You should allow up to five years to apply for a patent.

Of these, patents are by far the strongest form of protection, but the most complicated to understand.

Patenting your invention

Patents are the most common choice for many tech startups, but they are far from easy to obtain, as only 1 in 20 applicants gets a patent without professional help. The five-year application process for a patent costs £4,000.

Once you have held a patent for four years, you must renew it for a fee. This starts at £70 and increases each year up to £610 for the 20th year, after which you can no longer renew it. The government website has more information on the patent renewal fees and process.

How can Berley help?

As specialist accountants for tech companies in London, we will work with you and legal professionals to help you protect your latest tech creation, which may include producing a business case and the process to apply for a patent, trademark or design registration. Regardless of the path taken, the goal is to protect your Intellectual Property.

The chartered accounts at Berley have been helping small businesses across London for many years, including tech start-ups. We are familiar with the challenges you face, as well as the growth opportunities. If you want to take your tech company to the next level, give us a call today on 020 7636 9094.

If you liked this article, why not take a look at:

Is Your Restaurant in Trouble?

Just months after a report revealed that one-fifth of the UK’s restaurants are on the verge of insolvency, the start of 2018 saw popular casual dining chains struggle, and their owners selling off sites to make ends meet. The publicly-listed The Restaurant Group, owner of popular chains such as Chiquito and Wagamama, has been forced to sell more than 30 sites following losses of £22.5 million for the first half of the year. Casual Dining Group, another big company with over 300 restaurants across the UK, also reported a pre-tax loss of £60 million, despite an increase in total revenue. The restaurants that have fuelled our cities and towns a decade ago are seemingly collapsing.

More than anything, these are lessons. The high street is changing, and restaurants need to change with it in order to keep the cash flowing. Large chains may struggle to do this, as their size makes it difficult to change without extensive restructuring. However, smaller restaurant businesses do not face the same issues, and are free to adapt to the changing industry.

If your restaurant is struggling, then don’t despair – you can easily fix things if you know what is going wrong. Here are seven of the most common reasons businesses struggle.

Seven reasons restaurants struggle

- Unprepared for business growth – Sometimes a restaurant sees a sudden influx of business but is unable to react fast enough to meet the increased demands. They don’t have enough staff to meet the high demand, and there’s not enough time to hire and train new personnel. As a result, customers are left unhappy and the restaurant suffers a blow to its reputation that can be hard to recover from.

To avoid this, always ensure that you have a detailed plan for business growth: set out clear business goals and financial targets, and make sure you’re prepared to meet them. If you cannot reach your targets, then adjust your plan as necessary. - Intense competition – There are currently a lot of restaurants in and around London, which means the competition is fierce. The casual dining market is heavily saturated so you will need more than just good food to attract new customers. Consider what your USP (Unique Selling Point) is, and make sure it’s clear to the public. Going the extra mile to stand out from the crowd will increase your chances of attracting potential consumers.

- The falling pound – The formula is simple – when the pound is weak, it costs more to import goods from abroad. Restaurants that import their ingredients are finding it increasingly expensive to do so. Look for UK suppliers, and try changing your menu to avoid using ingredients that must be imported.

- Inadequate accounting methods and systems – As a manager, you should be leading the business through these difficult times. You can’t afford to spend the majority of your time sorting out VAT return or working on the business accounts, so it’s wise to hire professional bookkeeping accountants in order to crunch the numbers, saving you both time and money.

- Rise in minimum wage – The statutory minimum wage increased in April 2018 to £7.83 per hour, and is going to rise again to £8.21 per hour in April 2019. As a result, many restaurants are struggling to absorb the increased staff costs. Make sure you have the right amount of staff in your business - not too many, but enough to ensure high quality and consistent service. If you need assistance in managing your payroll, our outsourced payroll services can help.

- Poor location – When it comes to the high street, location is everything. If your restaurant is out of sight or catering to a demographic that isn’t common where you are, then your sales are going to suffer. Before you do anything, you should always be researching where you plan to sell from. Make sure you check the average age of your consumers, the social demographics that are most common in the area, and the number of people that pass by on average. Failure to do this research can be lethal for a business, especially since you’re unlikely to realise the problems until your business is already set up and trying to operate.

- Lack of staff – The UK’s decision to leave the EU is expected to hit the hospitality sector hard, as a quarter of Britain’s restaurant staff are EU nationals, and many of them may consider leaving after Brexit. Look to keep your staff retention high and your working conditions appealing – it may be more difficult to hire new staff than to keep your current roster.

Exploring your options

If you tackle these hard business issues early on, there may be a possibility to restructure your business and turn things around. If you can survive this rough patch, the possibilities are immense, as the once fierce competition will have dwindled significantly.

At Berley, our team of specialist hospitality accountants understand what you are facing and can provide specific help.

We’re also experts in business growth strategies – we can discuss your business plan and make sure it’s right for your restaurant’s vision, so you can avoid the common pitfalls.

The sooner you talk to us, the better. Once we have worked out a plan of action for your restaurant, we can support you through the process of implementing it.

Call Berley now on 020 7636 9094 to discuss how our expert team can help you, or get in touch via our Online Form.

If you found this article useful, take a look at:

- Are there opportunities for growth in the hospitality industry?

- Business Hacks: simple ideas to turn your business fortunes around

Are there opportunities for growth in the hospitality industry?

Some sectors in the hospitality industry may be going through a rough time but the outlook remains positive.

You may have read that a few restaurants have been hit hard, like Strada and Prezzo closing restaurants, and Jamie’s Italian being – in owner Jamie Oliver’s words – “two hours away from bankruptcy”, the news can leave you wondering if there are opportunities for growth in the food-service sector within the hospitality industry.

To many, the future is still bright particularly if the owners have a firm grip on the finances with help from our hospitality accountants. Your establishment can also grow and reap the rewards in this thriving industry. In this post, we look at 10 ways which you can grow your food-service sector in the hospitality industry.

Here are 10 ways you can grow your business in the hospitality industry

1. Increase sales opportunities

More and more people are going online to buy what they want. From run-of-the-mill items to restaurant take-outs, people are taking advantage of the convenience of the internet to make purchases, either via popular apps like Deliveroo or via the store’s website.

For restaurant owners, make sure you have a user-friendly website with an easy ordering function or partner with a few favourite delivery apps. These delivery companies charge you a commission (usually 10%). The clear advantage is that it can help you to gain more customers, but the con happens when your regular customers start to use the app to order, meaning you end up paying commission for customers who would have come to you anyway.

2. Put your customers first

We all heard this before but for the hospitality industry, this is paramount because when customers walk into a restaurant, they expect to receive exceptional service and from time to time, they may even expect you to bend the rules for them. It pays to figure out what makes you stand out in their eyes and keep that as an integral part of your business strategy.

It must be said that in the old days when a guest didn’t receive a good service, they would tell the staff right away or perhaps share it with a few friends. Today, however, they turn to social media, posting bad reviews that are likely to hurt your business. So here are a few tips to deal with negative online reviews:

- Respond immediately, preferably within 24 hours.

- Be professional and stay cool. Don’t get angry and don’t insult.

- Verify the situation and if it is a fake review, state what you have found and ask the person to remove it.

- Encourage your happy customers to post positive reviews.

3. Scrutinise your accounting

Many businesses fail due to poor financial management and control. You don’t have to be a trained accountant but if you understand the use of accounting and finance in the business context, you have the edge over your competitors. Get help from your hospitality accountants too – a good one should make time for you and use accounting information to help you make strategic decisions.

Scrutinising your accounting is particularly vital if you want to expand. In this instance, giving your business a health check by engaging an audit and accountancy service from Berley, because we can help to identify opportunities for growth and pinpoint weaknesses that need attention.

4. Learn from business leaders

The hospitality industry is one of the oldest industries and there are plenty of successful entrepreneurs with great insights. Learn from those who know how to set the right culture, build the best team, or turn the company around when things are tough.

The flip side of learning is sharing. If you are willing to share your experience in a conference or trade show, you can become a thought leader and increase the exposure of your company, which often lead to new partnerships or new sales.

5. Innovate

It sounds simple, but with so much competition around, following the status quo isn’t going to get you anywhere. You need to stand out from the crowd, bring a new product or service and market it in an eye-catching way. Fortunately, the hospitality sector is more lenient than most, so there’s plenty of room to be creative and remain competitive.

6. Pay attention to your equipment

You can’t put out a high-class service without high-quality features and facilities. When running a restaurant, your priority should be making sure that the kitchen equipment all works efficiently, your ordering system (web and onsite) is easy to use and the whole establishment is spotless. In the UK, more and more people are looking for good food hygiene standards so if you have received a high rating, emphasise it.

7. Take advantage of cloud-based systems

Using cloud-based restaurant POS and accounting software have many benefits including:

- Being cloud-based means they don’t require physical server hardware of your premises.

- They are subscription base and usually require no or minimum upfront costs.

- You don’t have to take care of any software updates.

- Support is readily available.

At Berley, we encourage our clients in the hospitality sector to use Xero, a simple-to-use accounting software built for entrepreneurs like yourself.

8. Market yourself online

As many of your potential customers tend to search online before visiting you, your online presence is just as important as your physical establishment. If you haven’t already invested in a website and social media, then make them your top priorities.

Be creative when it comes to market your food-service business online. Run location-based advertising during a quiet period and post mouth-watering food shots when it’s raining are some of the ideas.

9. Keep an eye on the competition

There are no denies that the food-serving business is highly competitive and to attract your customers, you must know your unique selling points and weaknesses.

10. Deal with staff turnover

It’s easy to recruit wait staff, but it’s also easy to lose them. Like it or not, the food-service sector has always had high staff turnover. Be realistic, maintain a positive attitude, keep a database of reliable temp staff who can step in to help, let your customers know some trainees are working tonight, these are just a few tips to help you deal with high staff turnover.

Berley – specialist hospitality accountants in London

Success in the food-service sector boils down to managing your finances right so you can focus on growth. At Berley, we are accountants for small businesses in London with a focus on hospitality accounting. We help you to take care of your financial affairs so you can focus on doing what you do best.

From pricing strategies to tax planning, our hospitality accountants are keenly aware of the challenges you face, which is why we offer a bespoke service that is ideal for your food-service business.

To find out more get in touch on 020 7788 8261 or fill out our Online Form.

If you enjoyed this article, then you may want to take a look at:

- Business hacks: simple ideas to turn your fortunes around

- Expecting the unexpected: hidden business costs

Eight tips for creative agency success

Previously, we discussed how to turn your business fortunes around with simple growth hacks that can be applied to businesses across all sectors. As specialist accountants for various industries including creative media, we know that our clients are facing different challenges unique to the industry they’re in. In this post, we examine eight ways creative SMEs can better position themselves for success and business growth next year.

Previously, we discussed how to turn your business fortunes around with simple growth hacks that can be applied to businesses across all sectors. As specialist accountants for various industries including creative media, we know that our clients are facing different challenges unique to the industry they’re in. In this post, we examine eight ways creative SMEs can better position themselves for success and business growth next year.

1. Know your competitors and yourself

As Sun Tzu once said, if you know your enemies and know yourself, you will not be imperilled in a hundred battles. To achieve business success and better position your creative agency for business growth, analyse your business’ strengths and weaknesses and see how they can work to your advantage.

2. Use cloud accounting

Cloud accounting software can help to streamline your business, and with the Making Tax Digital scheme deadline approaching, there’s never been a better time to get acquainted with the software. A cloud-based accounting software such as Xero can help with everything from managing projects to keeping your payroll sorted.

3. Retain your staff

The UK’s creative industry is growing at a fascinating rate. Recent figures from the Department for Digital, Culture, Media and Sport (DCMS) show that the creative industry has grown at nearly twice the rate as the economy since 2010. Additional research also suggests that job-hopping has become an acceptable norm in the UK. Although retaining your staff is the priority, it pays to keep this in mind when you do your budget - factoring in recruitment costs can be a wise move.

4. Focus on long-term strategies

Focusing on short-term success rather than playing the long game is a common trap that many entrepreneurs fall into. To be successful, you need to create a detailed and thorough business plan for the future and be prepared for any changes in the industry or market.

5. Never stay still

The creative industry is notorious for being fast-paced. Styles and trends can be popular one day and outdated the next, so it’s important to be aware of how potential changes will affect your business. Being able to adapt and ride with the changes are key to growing your agency.

6. Set milestones

The stereotype is creative people aren't organised, but everyone can learn to appreciate structure if it benefits the company. As an owner of a creative agency, if you have a team of highly creative people who are disorganised, you know it isn't going to work because projects need to be managed well and delivered on time. To help your team focus, remove distractions and set milestones - and make sure your team follows them - so the company can continue to grow.

7. Keep customers at the centre of it all

Sometimes, the best way to achieve growth and success is to start with existing customers instead of finding new ones. Find out what your existing customers like and dislike about your business and improve it. This will increase the value of the service your creative agency provides. Also, when customers realise that you’re listening to their feedback, they are more likely to continue engaging your services.

8. Keep an eye out for partners

Partnerships can be tremendously useful to a creative agency because it can bring new ideas and knowledge that your company needs to grow. For example, a traditional design agency partnering with a UX company means both parties have now increased their customer base and able to service both online and offline clients.

Working with Berley

As accountants for the creative industry, we’ve been consulting with creative entrepreneurs over the past 20 years on how to grow their business, and we’ve learned a lot about the opportunities and challenges they’re facing. As small business growth specialists, we can help you position your creative business for business growth and success, so talk to us today on 020 7636 9094. We’re excited to hear from you.

If you enjoyed this article, take a look at:

IR35: What you need to know

In April 2017 IR35 underwent some changes that were confined to the public sector. Now the new legislation is set to affect the private sector as well, meaning it’s more important than ever to understand this complex law. Here is what you need to know and why getting the help of an accountant from Berley is vital.

In April 2017 IR35 underwent some changes that were confined to the public sector. Now the new legislation is set to affect the private sector as well, meaning it’s more important than ever to understand this complex law. Here is what you need to know and why getting the help of an accountant from Berley is vital.

What is IR35?

The Intermediaries Legislation was initially introduced in 2000 to combat ‘disguised employment’, where an individual can avoid tax by supplying services to clients via an intermediary, and would be an employee if the intermediary were not used. Simply put, disguised employees are those who do employee work under the title of contractor, to avoid paying certain taxes.

The most commonly cited example is the ‘Friday to Monday’ worker, where an employee leaves a company on Friday and returns to the same job as a contractor on Monday, paying less tax as a result. IR35 is designed to identify disguised employees and tax them accordingly as if they were employees.

There are three tests of employment to determine whether someone is a disguised employee rather than a genuine contractor:

- Control - If a client specifies where, when and how the contractor is to complete the tasks allocated on their contract.

- Substitution - If a contractor cannot send a replacement, or a substitute, to complete the tasks for the client on their behalf.

- Mutuality of obligation (MOO) - If a contractor expects the client to give them work, and the client expects the contractor to complete it.

If any of these apply to a contractor then they are considered to be under IR35. Although several other factors can determine employment, in a courtroom these three are the most important.

What happens if you fall under it?

As a contractor, the main effect is a sharp increase in the tax you will pay, due to being classed as a disguised employee. Employees must pay both PAYE and National Insurance tax and you will be required to make up for any tax you would otherwise have paid in the form of ‘deemed employment payments’. The method of calculating these payments is very complicated, so it’s advisable to seek specialist help. Our accountants can work out the payment and show you exactly what you must pay.

You can also calculate the effect falling under IR35 has on your income using this calculator.

What can you do?

Falling under IR35 is quite expensive in terms of extra tax but provides none of the benefits of full employment, although thanks to a recent tribunal case this may soon change. For many, it is simply a case of working around the legislation. However, if you feel you have been wrongfully categorised, then you do have the option of taking the matter to court.

Of the previous 24 court cases concerning IR35, HMRC has won around half of them. This is primarily due to the inaccuracy of the Check Employment Status for Tax tool (CEST) - HMRC has admitted it does not take into account MOO, despite also stating that only assessments conducted using it will be recognised in court. Thus the success rate for these kinds of cases is relatively high.

Furthermore, due to the heavy penalties in place for knowingly avoiding tax under IR35, some companies have foregone assessing contractors individually and just assumed that all their contractors operate under IR35, a so-called blanket approach. In these cases requesting an individual assessment can properly determine whether you are inside or outside of IR35.

One final option that is becoming increasingly popular is to move to an umbrella company. Although working in an umbrella company means you must pay taxes equivalent to working inside IR35, you are also allowed to claim certain valid expenses that can mitigate the amount owed. Therefore the overall pay you take home is higher.

Get help from Berley

Some of the IR35 calculations are incredibly complicated. For example, calculating the deemed payment involves 11 separate stages, some of which are recursively dependent on others. Also, it’s known to affect small businesses - who are more likely to hire contractors for jobs - far more than large ones. In short, it’s a minefield for you and your income, but not an impassable one. At Berley, our specialist accountant contractors can help you navigate this legal maze.

To let us show you the way, get in touch on 020 7636 9094 or fill out our Online Form.

If you found this interesting, you may also want to read:

- Meet the construction industry scheme obligations with Xero

- Preparing your business for Making Tax Digital

- Getting the right accountant

Firefighting: what to do when things go wrong

We understand that running a business isn’t always a smooth road. Sooner or later you’re going to come across a hurdle as every business does. The inspirational success stories you hear come from the businesses that fought through the rough patches and came out changed for the better. The trick is knowing what to do and that’s where Berley can help. As specialist small business accountants, we have been providing business and financial advice to our clients for years.

Here are some of the most common problems businesses face and their solutions.

Uniqueness

Once upon a time, an entrepreneur was a rare thing. In recent times, business startups have become commonplace, and standing out from the crowd has never been more important.

You need to understand exactly what makes your product stand out from the competition, and show it to your customers. Perform a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to see what’s separating you from everyone else, what makes your business strong and what’s keeping it from growing. If you don’t know, then you should be reworking your product or branding until you do. Customers don’t just buy a product, they buy a brand, and you need to make sure yours is the strongest.

Business plan

There’s a reason why investors won’t even consider you without a good business plan. Planning for the future is necessary to ensure the health of your company, and it comes with its own set of benefits. As well as helping to manage your resources and cash flow, they can also be quite reassuring. It’s satisfying to tick the empty boxes next to your goals as you reach them, to know that you are doing the right thing.

The market and industry are always changing, and your plan should do the same. A business plan is not a shackle chaining you to a single path, but rather a guide that helps direct you as you move forward. A well-made one can help you to understand your market, focus your strategies and make realistic financial plans. For example, by looking at your financial targets you can identify which products are meeting your goals and which areas of your business need more attention.

Make sure you have an idea of where your business should be in a years’ time, in 5 years time, and measure it against the progress you’re making. If you’re struggling to look at the bigger picture, seek some specialist advice. We can help you with making a plan and - more importantly - sticking to it. Look at a business plan as an opportunity to show off what you’re going to do to everyone watching, and then prove that it’s a realistic set of goals.

Online presence

Operating a business in this age without an online presence is akin to running a company without doing any marketing whatsoever. It’s vital to get word of your product out there, and the fastest and most efficient way to do it is online.

Developing and refining a website, posting on social media daily, creating blog posts to drive people towards your website, these are all things that seem like they can be achieved relatively easily. However, it can be very difficult to build a following and convert them to buyers without some help. If you’re willing to invest, consider hiring specialists that can bring advanced SEO techniques to help get you rank higher in search results. Of course, outsourcing comes with a cost. We can assist with managing your business expenses so you don’t overspend.

Leadership

You can delegate responsibilities, you can outsource tasks, but at the end of the day you are the leader of your company. You need to set the example, and be aware that the effects will trickle down through every level of your business. Though you may not see these effects immediately, several years down the line they will come to the fore.

Solving a problem in leadership is difficult, because often it requires changing yourself. It’s not uncommon to start a business without experience in many of the associated areas, such as hiring, finance and HR, but what so many entrepreneurs fail to realise is that you can change this. If employees complain about work conditions listen to them, take their opinions in and act upon them. If you find yourself losing money in excess stock, then look at your finances, understand your sales and business months, figure out what and when you are selling. Every successful entrepreneur in the world has at least some of these skills, but none of them were born that way. Starting a business is as much an opportunity to improve yourself as it is to improve the world.

Fix the source, not the symptoms

Many would claim that a lack of cash is the leading cause of business failure, and in a way that’s true because financial collapse is the end of many an entrepreneur. But running out of money is more often an effect rather than a cause: the cracks in a business will show long before the cash flow dries up and these issues are what cause money problems in the first place. The best way to solve most problems is to go straight for the source rather than deal with the symptoms, and business is no different. By dealing with the root of the problem you can ensure they do not pose an issue going forward. See tackling issues as a way of improving, not as a chore that needs to be sorted out.

For those facing financial problems, our business finance solutions can help you source seed capital for your startup or funding for business growth.

You need a hero

Sometimes it can feel like a superhuman effort to drag yourself up and keep going. We know what it’s like because we’ve been in the same position. Berley is founded by entrepreneurs, for entrepreneurs, and we understand the problems facing a new business and what needs to be done to sort them out.

To find out more about how Berley can help your business, give us a call on 020 7636 9094, or fill out our Online Form.

Getting the right accountant

When you’re starting out in business, the idea is everything. It can be easy to forget about the paper trail that comes from pursuing it, but many entrepreneurs do. It’s not until the tax reports are piling up that they consider hiring an accountant.

When you’re starting out in business, the idea is everything. It can be easy to forget about the paper trail that comes from pursuing it, but many entrepreneurs do. It’s not until the tax reports are piling up that they consider hiring an accountant.

The legal side

Many of the basic principles of VAT, tax, and bookkeeping are public knowledge and can be found by a quick google search. But this is the tip of the legal iceberg when it comes to corporate law. You may know that you need to become VAT registered if your VAT taxable turnover is above £85,000 in a 12-month period, but are there any benefits to registering for VAT even if you haven’t hit the threshold? What’s Flat Rate VAT and how do you know which sales count under the Flat Rate Scheme?

The personal side

Paperwork is the chain holding you back from realising your idea. It’s often time-consuming and difficult to keep track of everything, and with the Making Tax Digital scheme coming into effect most businesses will be forced to use online accounting software to manage their books. Not only do our services deal with the paperwork quickly and effectively, but we also work directly with Xero, one of the biggest and most popular pieces of cloud accounting software on the market.

At Berley, since our inception we have been working with entrepreneurs, assisting them from one-time consultancy to long-term accounting services. We know the process better than anyone, simply because as entrepreneurs ourselves we’ve been through it.

Why do you need an accountant?

Where you are in your business growth stages, and your own schedule determine what you want from an accountant. For example:

- You have just started your business and you need an experienced accountant helping you with loan application.

- You have been in business for a while, but have yet to stay on top of cash flow. An accountant can work with you to develop cash flow projections based on various scenarios.

- You are spending many hours a week doing your own bookkeeping when you can better spend the time at business development and closing deals.

- You have hired a couple employees and would like to outsource the payroll service.

- You need an accountant to prepare the management reporting and statutory compliance.

- You’re now on the upward growth path and would like to expand your business.

In short, regardless where you are in your business growth stages, getting advice and assistance from an experience accountant will only benefit you and your business.

Xero

The Making Tax Digital scheme plans to have all tax reporting managed and sent digitally to the HMRC, meaning that by April 2019 businesses will be mandated to use the system. It’s essential to start as you mean to go on, and if you’re going to use a digital system to manage your accounts, you should aim for one of the best. Xero’s multi-award-winning software is one of the market leaders, compatible with over 700 third-party applications like PayPal. It covers a wide variety of business needs, including:

- Invoices

- Inventory

- Quotes

- Tax payments

- Purchase orders

- Asset management

- Multi-currency accounting

At Berley we’re also Silver Champion Partners with Xero, giving us access to exclusive member perks that we are more than willing to share with our clients, such as access to the Xero advisor directory.

How to choose your accountant

Certified or chartered - make sure your chosen accountants are regulated by a professional body like the ICAEW and the ACCA or by the government.

Resolute heart - if you have the courage and passion to succeed, you want your accountants to be in the same wavelength too. If you are a risk-taking entrepreneur, consider working with an accountant who can share your vision.

Look at their reviews - research how other current or previous clients view their experience with them.

Once you have narrowed down your choices, set up a meeting and have an honest discussion with them. How they will work with you, the availability of your primary contact and their experience in cloud-based accounting are good questions to ask.

Why choose Berley?

Berley Chartered Accountants is founded by entrepreneurs, for entrepreneurs. We know first-hand the challenges of starting out, that’s why we make it our mission to serve entrepreneurs and start-ups across London.

In addition to standard accounting (management account, payroll, bookkeeping, company audit, and tax), we can provide bespoke financial advice to help you to grow your business. We offer advice on the appropriate sources of funding, help to develop strategies for a successful business exit and support businesses that are international.

Call us on 020 7636 9094 or use our contact form for more information on how we can work with you.

If you found this interesting, you might also like:

- Meet the Construction Industry Scheme obligations with Xero

- The benefits of using Xero for your payroll

- The top 5 common questions about Xero

- How to get the most out of Xero

- Preparing your business for Making Tax Digital

- Cloud accounting: top user mistakes and how to avoid them

- Keep track of your projects with Xero

- Getting the most out of Xero with Berley

Meet the Construction Industry Scheme obligations with Xero

What is the Construction Industry Scheme?

Every construction business in the UK needs to adhere to tax rules and regulations set by the Construction Industry Scheme (CIS), applying to both contractors and subcontractors (anyone who does construction work for a contractor). Any business or individual who pays subcontractors for construction work is classed as a contractor under CIS and must register with HMRC before any construction work begins. After a contractor has paid a subcontractor, 20% of the payment is deducted and paid directly to HM revenue and customs on their behalf. This can be increased to 30% if:

- You are not registered for CIS

- The contractor cannot verify the subcontractor

- You give the wrong name for your business

The scheme has the benefit of reducing tax avoidance and tax evasion, as well as helping subcontractors spread their income tax burden across the year in line with their income. There are a lot of tasks and calculations required to meet the government legislation, including:

- Verifying the subcontractors

- Registering for CIS

- Submitting monthly returns to HMRC

- Deducting payments

- Sending monthly payments and deduction statements to contractors

- Keeping records of all payments and deductions

However Xero can help to manage these.

Managing obligations with Xero

Invoices, bills, statements and returns are just some of the tasks involved in your business. We know it can be hard and time-consuming to ensure all calculations and deductions are done regularly and with no errors.

Xero is simple accounting software that helps contractors, subcontractors and accountants in managing CIS. Deductions from invoices and returns to the HMRC are processed automatically with the click of a button – keeping you in control of your payments.

Xero offers a wide range of online features and tools, such as:

- Fast online invoicing and online payments options

- Apps for inventory management, project management, time tracking and more

- Xero dashboard to check on cash flow at any time

- Mobile app to manage your business financials

- Add all contractor and subcontractor information

- Automate all CIS calculations

- Automatically calculate CIS deductions before making payments

- Automatically produce contractor monthly CIS Return in simple steps

- CIS suffered reports

- Payroll integration

- And much more...

With accurate and efficient calculations, Xero can help you complete your business tasks quickly wherever you are, from offices to building sites.

Talk to Berley for more information

As Silver Champion Partners to Xero, we’re here to answer any questions you might have. To talk to us directly, give us a call on 020 7636 9094 or use our online form. You can also find out more about how Xero can apply to different aspects of your business here:

For more information about Xero, you can check out:

- The benefits of using Xero for your payroll

- The top 5 common questions about Xero

- How to get the most out of Xero

- Preparing your business for Making Tax Digital

- Cloud accounting: top user mistakes and how to avoid them

- Keep track of your projects with Xero

- Getting the most out of Xero with Berley